nh bonus tax calculator

In 2021 you will pay FICA taxes on the first 142800 you earn. If you make 55000 a year living in the region of New York USA you will be taxed 12213.

Llc Tax Calculator Definitive Small Business Tax Estimator

Consequently the median annual property tax payment here is 5768.

. 300000 x 015 4500 transfer tax total 2. Overview of New Hampshire Taxes. Your contributions will come out of your earnings before payroll taxes are applied.

If you are unable to view the 1099G on your dashboard please continue to check for your paper 1099-G arriving by traditional mail. Take the purchase price of the property and multiply by 15. New Hampshire Bonus Tax Aggregate Calculator Results Below are your New Hampshire salary paycheck results.

Calculate withholding on special wage payments such as bonuses. This is the 24th-highest cigarette tax in the US. As an aside unlike the federal government states often tax municipal bond interest from securities issued outside a certain state and many allow a full or partial exemption for pension income.

The limit was 137700 in. The gas tax in New Hampshire is equal to 2220 cents per gallon. This marginal tax rate means that your immediate additional income will be taxed at this rate.

State Date State. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long-term capital gains or qualified dividends.

Use this calculator to help determine. People with more complex tax situations should use the instructions in Publication 505 Tax Withholding and Estimated Tax. This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Social Security is taxed at 62 and Medicare at 145. New Hampshire Gas Tax. If you arent sure how much to withhold use our paycheck calculator to find your tax liability.

While they dont impose a tax on income there is a state tax on interest and dividends. Call the Departments Tobacco Tax Group at 603 230-4359 or write to the NH DRA Tobacco Tax Group PO Box 1388 Concord NH 03302-1388. This is known as the Social Security wage base limit.

Federal Bonus Tax Percent Calculator. One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. State Date State New Hampshire. You will receive a 1099G if the total amount of Unemployment Benefits paid to you during calendar year 2021 is at least.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. 4500 2 2250. Using deductions is an excellent way to reduce your New Hampshire income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your Federal and New Hampshire tax returns.

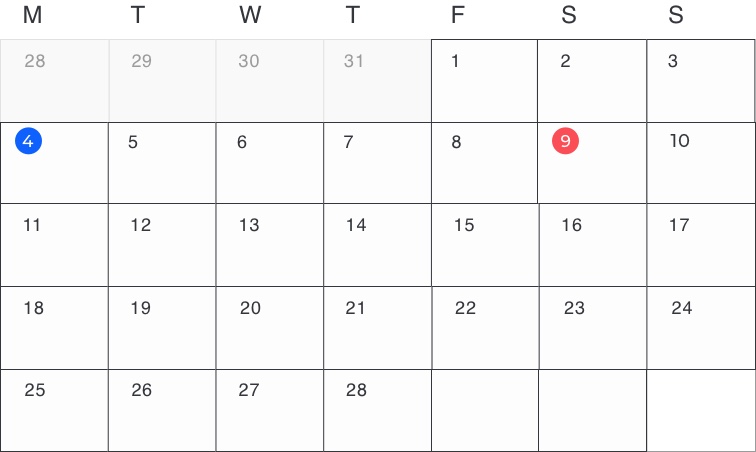

The New Hampshire bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. This information may help you analyze your financial needs. New Hampshire Bonus Tax Calculator - Percent PaycheckCity This calendar reflects the process and dates for a property tax levy for one tax year in chronological order.

Currently New Hampshires business taxes make up 25 of the states revenue. State with an average effective rate of 205. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems.

The results are broken up into three sections. The results are broken up into three sections. Tennessee and New Hampshire fall into a gray area.

If calling to inquire about the purchase of Tobacco Tax Stamps please contact the Collections Division at 603 230-5900. The calculations do not infer that the company assumes any fiduciary duties. If youre already living well within your budget consider increasing your contributions to tax-advantaged accounts like a 401k HSA or FSA.

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Your average tax rate is 222 and your marginal tax rate is 361.

Change state Check Date General Federal Supplemental Flat Bonus Gross Pay Gross Pay Method Gross Pay YTD Pay Frequency Use 2020 W4. After a few seconds you will be provided with a full breakdown of the tax you are paying. A bonus from your employer is always a good thing however you may want to estimate what you will actually take-home after federal withholding taxes social security taxes and other deductions are taken out.

Divide the total transfer tax by two. New employers should use 27. New Hampshire Cigarette Tax.

New Hampshires excise tax on cigarettes totals 178 per pack of 20. That means that your net pay will be 42787 per year or 3566 per month. And remember to pay your state unemployment.

But while the state has no personal income tax and no sales tax it has the fourth-highest property tax rates of any US. That tax applies to both regular and diesel fuel. New Hampshire does tax income from interest and dividends however.

New Hampshire Tax Deductions Income tax deductions are expenses that can be deducted from your gross pre-tax income. The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Heres how to find that number. This Tax Withholding Estimator works for most taxpayers. This tax is not paid directly by the consumer.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. In NH transfer tax is split in half by buyer and seller. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

If your state doesnt have a special supplemental rate see our aggregate bonus calculator. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Your federal tax forms 1099G for the 2021 tax year will be available online by January 31st.

New Hampshire is known as a low-tax state. New Hampshire Bonus Tax Percent Calculator Results Below are your New Hampshire salary paycheck results. It is based on information and assumptions provided by you regarding your goals expectations and financial situation.

Use this calculator to help determine your net take-home pay from a company bonus.

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

Minnesota State Income Tax Mn Tax Calculator Community Tax

Llc Tax Calculator Definitive Small Business Tax Estimator

Bonus Tax Rates Aggregate Bonus Pay Calculator Onpay

How Is Tax Liability Calculated Common Tax Questions Answered

Bonus Calculator Percentage Method Primepay

Bonus Tax Calculator Percentage Method Business Org

Flat Bonus Pay Calculator Flat Tax Rates Onpay

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

Minnesota State Income Tax Mn Tax Calculator Community Tax

New Hampshire Payroll Tools Tax Rates And Resources Paycheckcity

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

How Bonuses Are Taxed Credit Karma Tax